florida estate tax rates 2021

Floating Rate of Interest Remains at 7 Percent for the Period January 1 2022 Through June 30 2022. The base state sales tax rate in Florida is 6.

Miami-Dade County collects the highest property tax in Florida levying an average of 275600 102 of median home value yearly in property taxes while Dixie County has the lowest.

. Counties in Florida collect an average of 097 of a propertys assesed fair. Welcome to the Florida Property Tax Data Portal a service of the Florida Department of Revenues Property Tax Oversight PTO program. The average Florida homeowner pays 1752.

This portal provides all of PTOs. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. Property taxes in Florida are implemented in millage rates.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. Broward County Florida Property Tax Go To Different County 266400 Avg. Floridas general state sales tax rate is 6 with the following exceptions.

108 of home value Yearly median tax in Broward County The median property tax in Broward County. The median property tax in St. Florida estate tax rates 2021 Saturday March 12 2022 Edit.

A millage rate is one tenth of a percent which equates to 1 in taxes for every 1000 in home. The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. Florida Property Tax Rates.

Find your Florida combined state and local. Osceola County collects on average 095 of a propertys. There is also an average of 105 percent local tax added onto transactions giving the state its 705 percent state and local sales tax.

Florida Tax and Interest Rates The Interest Rates section identifies interest rates for the late payment of tax and includes instructions on how to calculate interest due. Lucie County collects on average 124 of a propertys. Lucie County Florida is 2198 per year for a home worth the median value of 177200.

However the estate tax can be as high as 40 percent or as low as 18 percent. Florida has a sales tax rate of 6 percent. Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale.

The median property tax in Osceola County Florida is 1887 per year for a home worth the median value of 199200. Since Floridas estate tax was based solely on the federal credit estate tax was no longer due on estates of decedents that died on or after January 1 2005. Local tax rates in Florida range from 0 to 2 making the sales tax range in Florida 6 to 8.

Estate Tax Rate Floridas estate tax rate varies on a marginal tax bracket according to your net worth. This data is based on a 5-year study of median property tax rates.

Moved South But Still Taxed Up North

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Florida Real Estate Taxes What You Need To Know

Maine Governor Lepage Proposes Good Tax Policy In New Budget Tax Foundation

Estate Tax Law Changes What To Do Now

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Florida Estate Tax Everything You Need To Know Smartasset

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Estate Taxes Are Levied At Rates As High As 40 On Some Assets After Death

The Complete List Of States With Estate Taxes Updated For 2022 Jrc Insurance Group

2021 State Corporate Tax Rates And Brackets Tax Foundation

The Estate Tax And Real Estate Eye On Housing

Estate Planning Tips Married Floridians Need When They Near The Proposed Tax Limits Elder Law Attorney St Augustine J Akin Law

2021 2022 Gift Tax Rate What It Is And How It Works Bankrate

Florida Attorney For Federal Estate Taxes Karp Law Firm

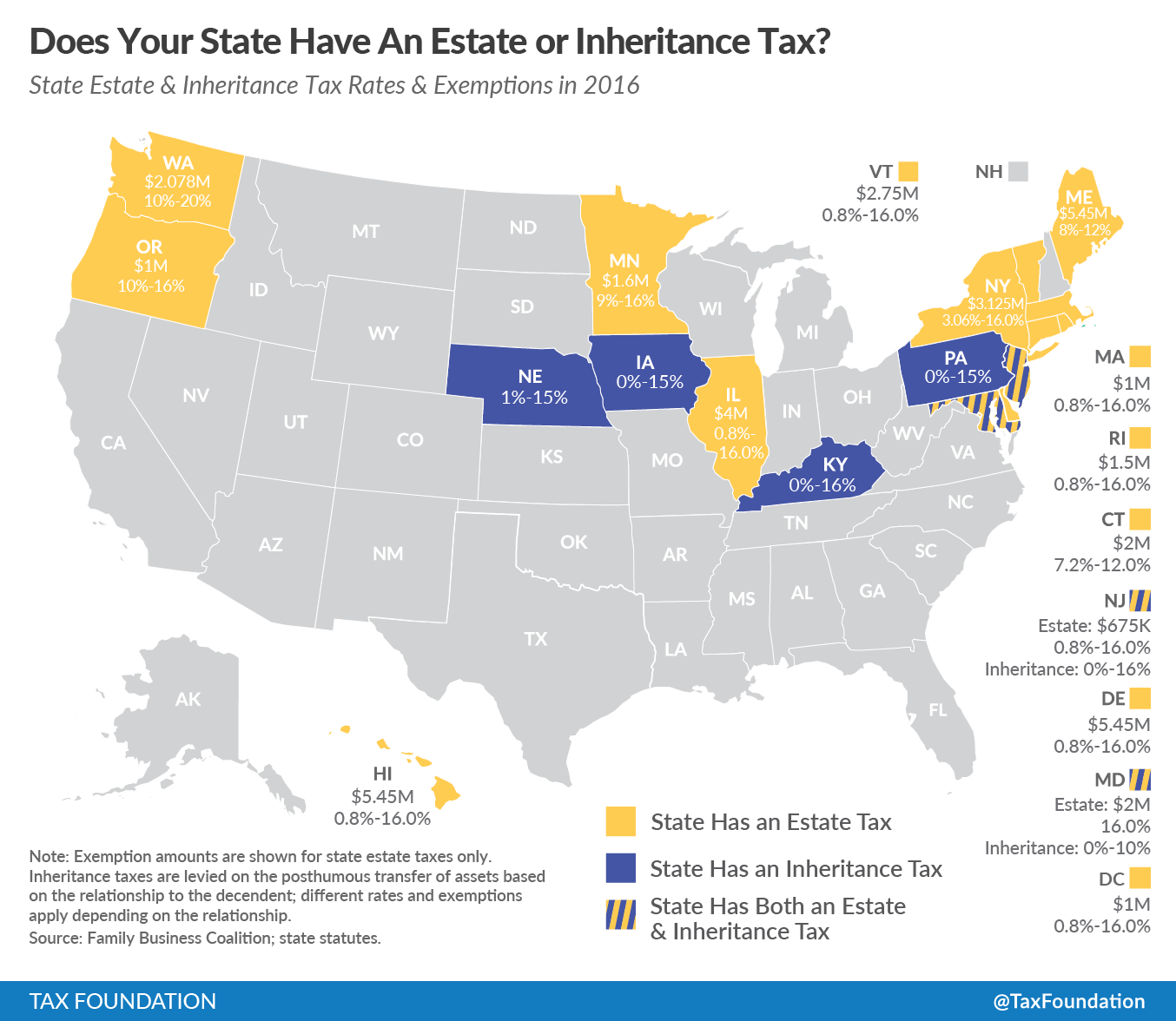

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Desantis Delivers An Estate Tax Savings Gift For Floridians

General Sales Taxes And Gross Receipts Taxes Urban Institute

:max_bytes(150000):strip_icc():gifv()/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)